An Unbiased View of Buy Sell Signal Software

There are hundreds of equities to select from, and day investors can pick practically any type of supply they desire. So the initial action in day trading is finding out what to trade. As soon as one, or a number of, stocks or ETFs have actually been selected, the following step is creating some methods to benefit from them.

The initial step in day trading is identifying what to trade. As soon as one, or a number of, supplies or ETFs have actually been selected, the following action is generating some means to make money from them. Just How To Pick Stocks For Day Trading Fluid supplies have big volume, wherein larger quantities can be bought and also marketed without considerably affecting the rate.

Deepness is likewise important, which reveals you exactly how much liquidity a stock contends various rate levels over or listed below the existing market bid as well as deal. Day traders call for price activity in order to make cash. Day investors can choose stocks that often tend to relocate a great deal in dollar terms or percent terms, as these two filters will usually produce various outcomes.

The same is real for supplies that have a tendency to move greater than $1.50 each day. While there are those who specialize in contrarian plays, a lot of traders search for equities that relocate in correlation with their market as well as index group. This suggests that, when the index or the industry tick up, the private stock's price likewise increases.

If an investor opts to trade the exact same supply each day, it is a good idea to concentrate on that stock, and also there is no demand to bother with whether it is correlated with anything else. Day trading is high-risk and requires knowledge, skill, and also discipline. If you are looking to make a big win by wagering your cash on your sixth sense, try the gambling enterprise.

8 Easy Facts About Nifty Chart Described

Intraday strategies are as countless as traders themselves, however by sticking to specific guidelines and also looking for certain intraday trading signals, you are more most likely to be successful. Here are five such guidelines. The marketplace constantly relocates in waves, and also it is the investor's task to ride those waves. During an uptrend, concentrate on taking lengthy settings.

Intraday patterns do not proceed indefinitely, but normally one or 2 professions, and sometimes a lot more, can be made before a reversal happens. When the dominant pattern shifts, begin patronizing the brand-new fad. Separating the pattern can be the hard part. Trendlines give a basic and also useful entrance and also stop-loss technique.

A lot more trendlines can be attracted while trading in genuine time to see the differing degrees of each pattern. Attracting in even more trendlines may give more signals and might additionally offer greater insight right into the altering market characteristics. To pick the finest supplies for intraday trading, most traders will certainly locate it beneficial to check out equities or ETFs that contend least a modest to high correlation with the S&P 500 or Nasdaq indexes, and after that isolate those supplies that are reasonably weak or solid compared to the index.

There is more possibility in the stock that moves extra. When the indexes/market futures are moving higher, traders need to seek to acquire stocks that are moving up much more boldy than the futures. When the futures draw back, a strong stock will not draw back as much, or might not even pull back whatsoever.

When the indexes/futures are dropping, it can be rewarding to brief sell supplies that drop more than the market. When the futures move greater within the sag, a weak supply will not move up as a lot, or will certainly not move up at all. Weak supplies provide better earnings capacity when the marketplace is dropping.

The 6-Minute Rule for Intraday Tips

The adhering to graph contrasts the SPDR S&P 500 to the SPDR Select Innovation Fund (XLK). Heaven line, XLK, was reasonably strong contrasted to SPY. Both ETFs relocated higher throughout the day, but because XLK had such large gains on rallies and also slightly smaller sized declines on pullbacks, it was a market leader as well as outshined SPY on a family member basis.

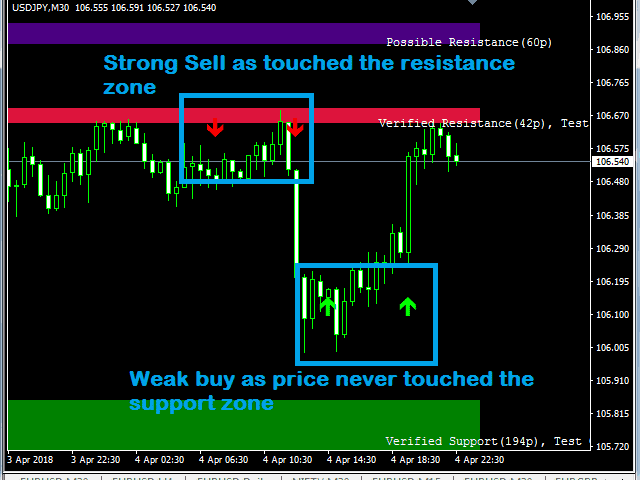

The exact same clings short professions. Short sellers need to isolate supplies or ETFs that are fairly weak. By doing this, when prices drop, you are most likely to be in stocks or ETFs that will fall one of the most, thus boosting the earnings possibility of the trade. Trendlines are an approximate visual overview for where rate waves will certainly begin and also end.

When going into a long placement, get after the price relocates down toward the trendline and after that moves back higher. To attract a higher trendline, a price low and after that a higher price low is required. The line is drawn linking these 2 factors and after that extended bent on the right.

Brief marketing in a sag would certainly be similar. You must wait up until the price goes up to the downward-sloping trendline, then when the stock begins to return down, you use this as a trading signal to make your access. By holding your horses, these two lengthy trades give a low-risk entry.

As discussed previously, trends don't continue indefinitely, so there will be losing professions. However as lengthy as an overall revenue is made, even with the losses, that is what issues. 35.8% The percent of day investors who earn an internet profit above zero after fees, according to one released study.

The 6-Second Trick For Intraday Tips

Right here are 2 easy standards that can click resources be made use of to take earnings when patronizing patterns. In an uptrend or long placement, take revenues at or slightly over the previous cost high in the existing trend. In a downtrend or short position, take revenues at or somewhat below the previous cost reduced in the current fad.

The chart reveals that, as the fad proceeds higher, the cost pushes with previous highs, which supply a departure for each respective long position taken. The same technique can be put on sags; revenues are taken at or slightly below the prior cost reduced in the fad. Markets don't buy sell signal software for nse constantly fad.

SERVICES PROVIDED

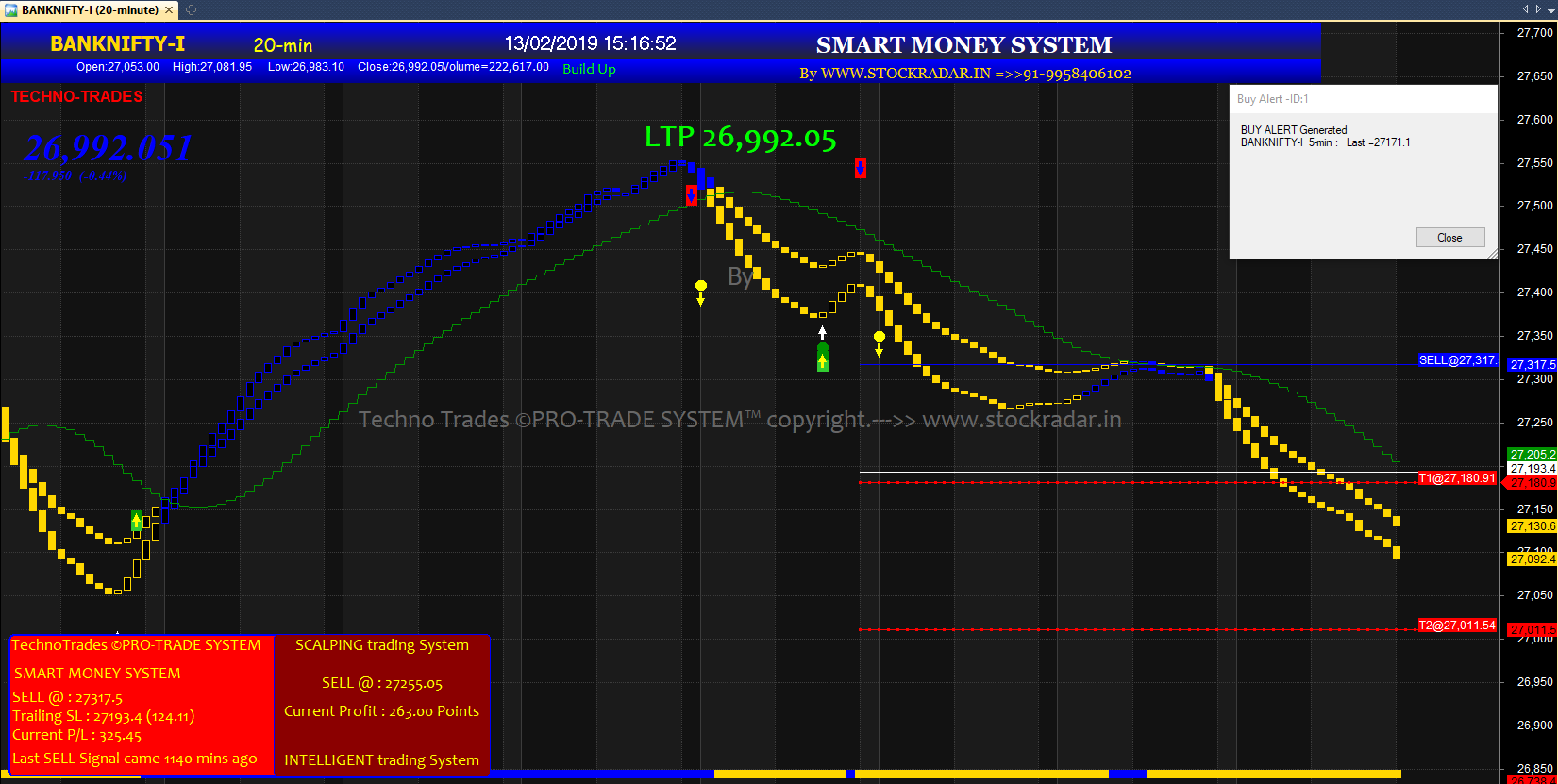

bank nifty chart

nifty chart

nifty live chart

intraday trading

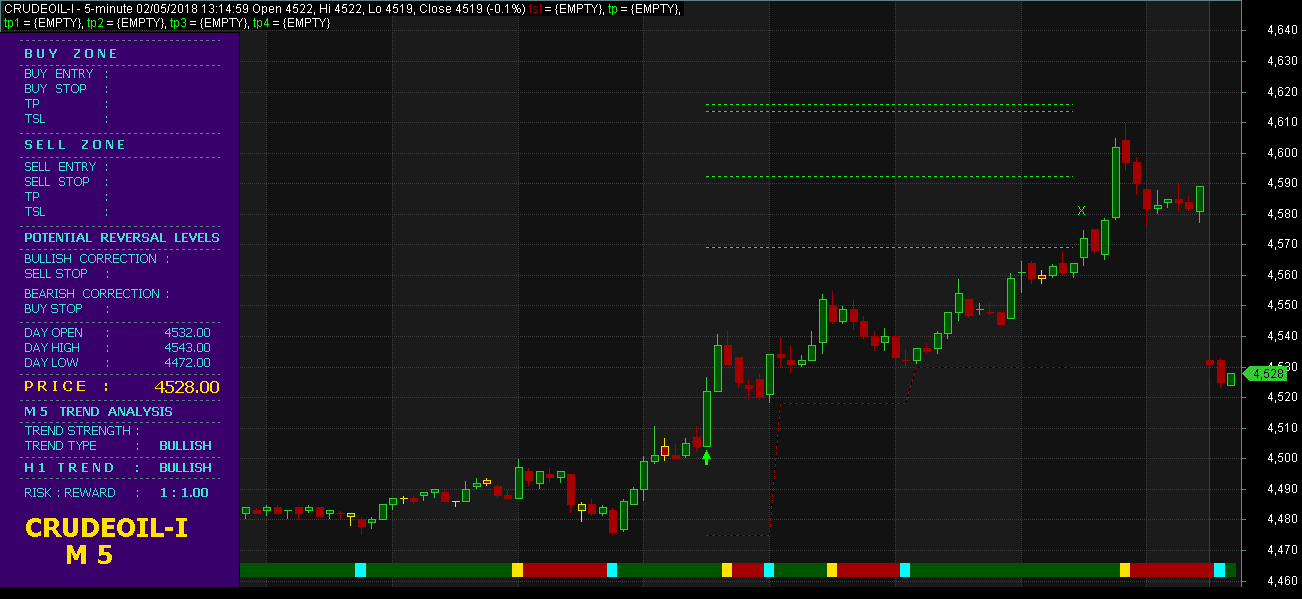

mcx live charts

intraday tips

intraday trading strategies

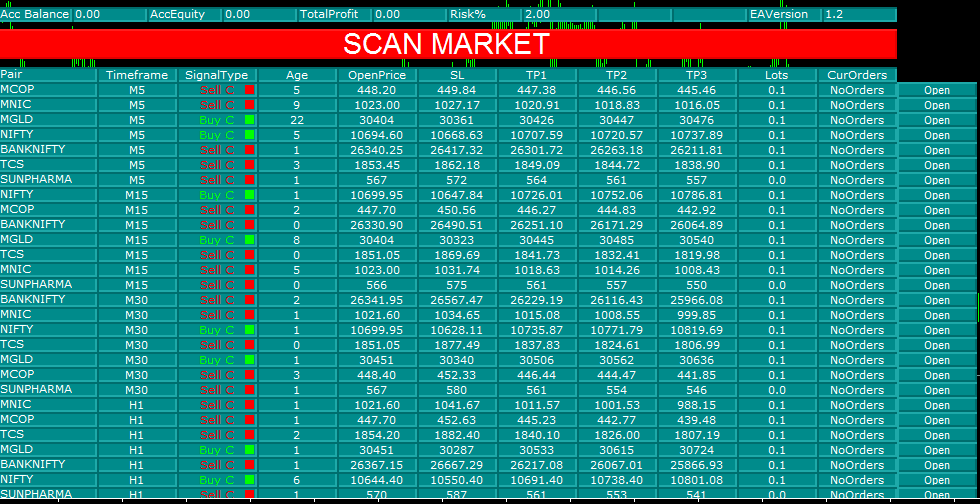

BUY SELL SIGNAL SOFTWARE

CONTACT : 91-9958406102

[email protected]

http://www.stockradar.in/

check out below:

https://www.stockradar.in/

https://www.stockradar.in/robot-scalper/

https://www.stockradar.in/auto-buy-sell-signals-software/

https://www.stockradar.in/mt-4-intraday-software/

https://www.stockradar.in/smart-scalping-multi-systems/

https://www.stockradar.in/pro-trade-tools-bundle/

https://www.stockradar.in/mt-4-buy-sell-systems/

https://www.stockradar.in/reversal-zone-signals/

https://www.stockradar.in/multi-symbol-multi-time-frame-system-mt-4/

https://www.stockradar.in/multi-map-buy-sell-system/

https://www.stockradar.in/power-zone-scalping-mt4/

http://www.stockradar.in/trend-line-patterns-breakout-signals-system/

https://www.stockradar.in/auto-trading-strategy/

https://www.stockradar.in/auto-trading-strategy/robot-trading/

https://www.stockradar.in/forums/

https://www.stockradar.in/videos/

http://blog.stockradar.in/

If major low and high are not being made, ensure the intraday motions are large sufficient for the prospective benefit to exceed the threat. For example, if risking $0.10 per share, the stock or ETF ought to be relocating enough to give you a minimum of a $0.15 to $0.20 profit using the guidelines over.